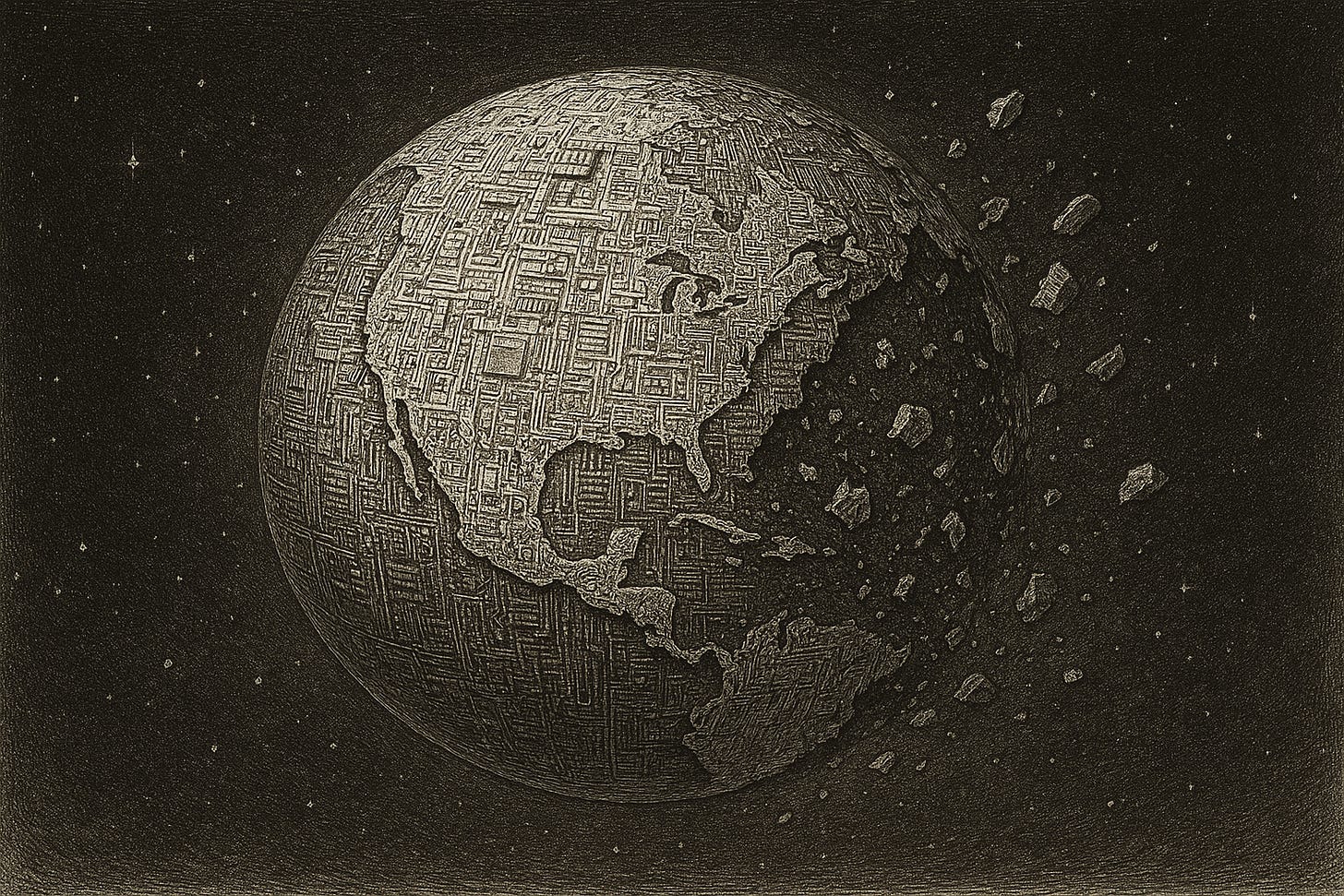

China has copied America's grab for semiconductor power

Six theses about the consequences

I’m quoted this morning in a great New York Times piece by Ana Swanson and Meaghan Tobin, which explains how China is using rare earths to do to other countries what the US has been doing for years.

“The U.S. now has to face up to the fact it has an adversary which can threaten substantial parts of the U.S. economy,” said Henry Farrell, a political scientist at the Johns Hopkins School of Advanced International Studies. The United States and China are now very clearly “in a much more delicate stage of mutual interdependence,” he added.

“China has really begun to figure out how to take a leaf from the U.S. playbook and in a certain sense play that game better than the U.S. is currently playing it,” Mr. Farrell said.

But read the whole thing. It’s the best detailed account of what is happening between China and the US on semiconductors right now that I’ve seen to date, and draws on the knowledge of lots of people beside myself. What follows is not narrative journalism, but an explainer of the background to the story, as I at least interpret it, in the form of six broad theses.

First, and most simply: China seems to be moving from one mode of exercising its power to another. China has exercised effective control over rare earths and other critical minerals for years, but when it has used or threaten to use it, it has done so implicitly and indirectly. Specifically, it has used informal restrictions: mysterious blockages, strange frictions and other means to hamper other countries’ access to China’s internal markets, and Japan’s access to rare earths in 2010. This led some observers even to doubt that China had introduced systematic restrictions on exports.

Now, there isn’t any doubt at all: China is explicitly asserting power over the entire semiconductor supply chain on the basis that semiconductors use China-processed rare earths. It has created an entire regulatory infrastructure to underpin this claim, and has effectively banned the export of rare earth processing equipment abroad, to try to maintain its chokepoint as long as possible.

Second, in doing this, China is very deliberately copying the US. The US Trade Representative, Jamieson Greer, is shocked, shocked, that any country could engage in this kind of “global supply-chain power grab”:

He said: “While China has taken a number of retaliatory trade actions against the United States, Europe, Canada, Australia and others in recent years, this move is not proportional retaliation. It is an exercise in economic coercion.

But China is in fact closely copying what the U.S. has been doing for years. See, for example, this super-useful chart by Gerard DiPippo.

As Abe Newman and I explain in our book, Underground Empire (if you want to support this free Substack, please go buy), officials in the first Trump administration used traditional export controls and a supercharged version of an obscure regulation, the “Foreign Direct Product Rule,” to assert jurisdiction over chips that had been manufactured outside the US. Chris Miller’s book, Chip War has a quote from a senior official suggesting that Abe’s and my ideas about “weaponized independence” played some role in the Trump administration’s thinking. The Foreign Direct Product Rule was first used to attack the Chinese telecommunications manufacturer, Huawei, and then deployed on a much wider scale by the Biden administration against Russia, and then China’s access to advanced AI chips.

The U.S. doesn’t like to publicly acknowledge that America too does economic coercion (one official even become indignant in private conversation with Abe and myself when we made this point), but it is clear that China is applying its own version of the Foreign Direct Product Rule. The consequences may be sweeping. As Swanson and Tobin explain:

The rules, which would go into effect later this year, shocked foreign governments and businesses, who would theoretically need to seek licenses from Beijing to trade in products ranging from cars to computer chips, even outside of Chinese borders. The system would also deny shipments to any U.S. and European defense or weapons manufacturers, who are still highly dependent on Chinese minerals.

Third, the bureaucracy to do this isn’t going away. U.S. Treasury Secretary Scott Bessent publicly blames a rogue Chinese official for going beyond his mandate.

Shifting from trade policy to the personal, Bessent on Wednesday described China’s chief trade negotiator Li Chenggang as “slightly unhinged” and “disrespectful”, alleging that he had threatened to “unleash chaos on the global system” if the U.S. went ahead with the port fees increases, and that he had invited himself to Washington for talks in August. … “Perhaps the vice minister who showed up here with very incendiary language on August 28 has gone rogue,” Bessent said.

I’m guessing (maybe wrongly) that this is a crude effort to provide Xi with a path towards de-escalation, by blaming an underling. But it appears to me to be unlikely that China’s rules will be withdrawn, and even if they are withdrawn, the bureaucratic structures that make them possible them will remain. Equally, China’s efforts to suggest that this is a purely technocratic exercise in protecting the environment etc are transparently mendacious. It is an explicit power play, backed up by the deliberate accretion of new bureaucratic authorities over the last few years.

Fourth (and this is where my comments to Swanson and Tobin came from), China appears to be better placed than the U.S. to use its powers of economic coercion intelligently in pursuit of its own long term interests. The Trump administration has junked the systems that allow the U.S. government to calibrate economic coercion and to anticipate possible downsides. The National Security Council - which had come to play a crucial role in coordinating and setting policy under the Biden administration - has lost more than half of its personnel, on the theory that it is the ultimate representative of the “Deep State.” Its key China people have been Loomered. Careful bureaucratic process has been replaced by the whimsical decision making of Trump himself, as in his infamous meeting with Jensen Huang. Bessent’s criticisms of officials “gone rogue” might better have been aimed at his own boss.

All this means that the US is likely to be highly unpredictable in its responses to China’s assertion of power. It might seek to double down on ferocious threats, or fold, depending on Trump’s mood, and the person he last spoke to. Who knows? China, in contrast, is much better placed than the US right now to think through the long term consequences of its actions.

Fifth - this doesn’t mean that China will necessarily get things right! Even when the US had proper bureaucratic structures, it regularly made big mistakes, and often didn’t have the information or capacities to think through the second and third order consequences of its actions. The same will be true of China, which is only beginning to figure out what it can or can’t do, and which moreover faces a much more complex set of problems than the U.S. did initially. When the U.S began to develop its muscles of economic coercion, no-one else was really capable of challenging it. China, in contrast, is challenging a relatively well entrenched competitor that already has built deep connections to, and considerable knowledge of, technology supply chains, and has many possible means of retaliation against Chinese actions.

That helps explain both why China is demanding information in return for licensing rare earth exports, and why companies and countries are resisting. Swanson and Tobin:

Companies and governments in the United States, Europe, Japan, India, South Korea and elsewhere are also concerned about the extensive corporate information that the Chinese government is requesting in the licensing process. Foreseeing “a lot of resistance” to providing that information, [Chris] Miller said it could accelerate efforts to build non-Chinese supply chains for rare earths. The argument is similar to one that critics of U.S. technology controls have long made, that they could push the world to adopt non-U.S. chip technology.

Again, this replicates what the US has done in the past. From Abe’s and my book:

On March 15, 2021, the Department of Commerce’s Bureau of Industry and Security (BIS) invited comments from the semiconductor industry. …Then, the Biden administration announced that it was asking businesses like TSMC to “voluntarily share information about inventories, demand, and delivery dynamics” to help the administration “understand and quantify where bottlenecks may exist.”

There was a big stick behind the soft-spoken request. As Biden’s commerce secretary, Gina Raimondo, explained, “What I told [semiconductor firms] is, ‘I don’t want to have to do anything compulsory but if they don’t comply, then they’ll leave me no choice.” If firms like TSMC didn’t provide the data, the Biden administration would invoke its powers under the Defense Production Act. Nor was the administration just demanding that TSMC provide information on its own activities. The data it wanted would allow it to peer into the intimate details of TSMC’s customers’ business.

But there is now a much higher likelihood of international conflict over whether companies should provide this kind of information. Semiconductor manufacturers and other customers for rare earths are likely to find themselves in an extremely difficult position, caught between warring demands.

And this carries to the sixth point. We are in the world that U.S. economic coercion has helped build, but it is not one that is good for the long term interests of the United States. As Abe and I said in 2019, in the conclusion to the article that apparently inspired at least one Trump official:

The world has entered into a new stage of network politics, in which other states have begun to respond to [U.S.] efforts. When interdependence is used by privileged states for strategic ends, other states are likely to start considering economic networks in strategic terms too. Targeted states—or states that fear they will be targeted—may attempt to isolate themselves from networks, look to turn network effects back on their more powerful adversaries, and even, under some circumstances, reshape networks so as to minimize their vulnerabilities or increase the vulnerabilities of others. Hence, the more that privileged states look to take advantage of their privilege, the more that other states and nonstate actors will take action that might potentially weaken or even undermine the interdependent features of the preexisting system.

Miller’s official either didn’t read this, or didn’t think it was very important (though Miller himself clearly got the implications of our claim).

We’re now living in a future where that prediction at least has come true. China has indeed reshaped networks so as to maximize the vulnerabilities of the US, creating a much more dangerous and unpredictable set of dynamics. The U.S. is currently very poorly positioned to manage these complex problems. The Trump administration is more concerned with attacking perceived internal enemies than the outside world, and has stripped the bureaucracies that would allow it to begin to think straight about the problem. China has better capacities to think in the long term, at least in principle - but it is also coming into the game very late, with little experience, and subject to its own misunderstandings. The risks of unanticipated and mutually compounding fuck-ups are very, very high.

"Underground Empire (if you want to support this free Substack, please go buy)" — Done.

Well I got a free copy of Underground Empire at APSA but if you publish another book (which you should) I will certainly buy it